Kakao Bank Account

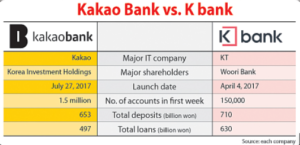

The banking service went into public in July 2017 in getting a huge spotlight mainly due to its simplicity and unique and intuitive UI and UX. The bank attracted more than 240,000 customers within the first 24-hour-operation. The mobile app-based lender has achieved more than 10 million customers on July 11, 2019, which is the largest in terms of customer volume among peers across the world, except for the Chinese peers.

kakaobank booked the first-quarter net income of KRW 6.6 billion in the first quarter ended March 31, 2019, in 7 quarters from its public opening on July 27, 2017. The South Korean neobank said its annual net income for 2019 is KRW 13.7 billion, the first annual-based net income of the company in two years from its public opening. Additionally, the lender reported the first-half net income of KRW 45.3 billion. In November, the bank reported that its accumulated net income by the third quarter ended at Sept. 30 was KRW 86.0 million. According to the bank’s annual report, cumulative net income for 2020 was KRW 113,6 billion, jumped from KRW 13.7 billion a year ago.

As of March 31, 2021, kakaobank’s customer volume is more than 14.2 million and balances of loan and deposit are KRW 21.6 trillion and KRW 25.4 trillion, respectively.

Services

kakaobank provides full-banking services under a regulatory banking license. The services include loan, deposit, debit card, overseas remittance, and other financial services such as group accounts.

Its deposit products include safe box, coin bank, time-deposit, and installment saving account, which customers can adjust maturity and installment amount. Based on AI the bank has created, it added in March an auto-saving function on its con bank product, which has analyzed the balance changes of a designated debit account during the last 6 months in order to calculate an amount that will be deposited to the coin bank account on every Saturday.

Its loan product line-up consists of prime credit loans, secured credit loans for mid-and-low credit holders, unsecured credit loans for mid-and-low credit holders, overdraft loans, microloan, and housing deposit loans. Its loan process has been carried out completely online, which means customers are not required to need to visit branches that do not actually exist.

Aside from conventional banking services, kakaobank has been providing group account service, stock account opening service, loan platform service, and my credit information service. In February, kakaobank added a new stock account opening service partnered with NH Investment & Securities, the second collaboration with a local brokerage following Korea Investment & Securities. In April 2020, the bank started providing the issuance business of credit cards under the partnership with four credit card issuers including Shinhan Card and Samsung Card. In October, kakaobank rolled out its first financial service for the country’s teenagers aged between 14 and 18, called ‘kakaobank mini’ which consists of a chargeable account and debit card. In November, more than 500,000 teenagers opened ‘kakaobank mini’ within a month after its launching in the previous month.

References

-

- “Kakao Bank accounts top 10 million”. The Korea Herald. Retrieved July 12, 2019.

- “Kakao Bank records first net profit of $5.5 mn in Q1”. Mail Business News. Retrieved May 15, 2019.

- “Kakao Bank posts first annual surplus in 2019”. The Korea Times. Retrieved March 18, 2020.

- “Kakao Bank records highest net profit in Q3”. The Korea Herald. Retrieved November 5, 2020.

- 카카오뱅크 “중금리 대출 강화”…상품 확대 (in Korean). Edaily. Retrieved February 2,2021.

- “Kakao Bank issues new shares to major U.S. hedge fund”. Korea JoongAng Daily. Retrieved October 27, 2020.

- “Kakao Bank makes IPO plans official”. Korea Herald. Retrieved September 24, 2020.

- 카카오뱅크 IPO 대표 주관사에 KB증권·CS 선정 (in Korean). The Chosun Biz. Retrieved December 11, 2020.

- 카카오뱅크, 오는 15일 상장 예비 심사 청구 예정…7월 코스피 입성하나 (in Korean). The Financial News. Retrieved April 13, 2021.

- “Kakao Bank to come under the sole leadership of Yun Ho-young”. The Korea Times. Retrieved March 17, 2020.

- “100 people transforming business in Asia”. Business Insider. Retrieved September 9, 2020.

- 카카오뱅크 윤호영 대표 연임 사실상 결정…임기 2년 (in Korean). Yonhap News Agency. Retrieved March 3, 2021.

- 월화수목금’토’ 저축…카카오뱅크 ‘저금통’ 규칙 추가 (in Korean). Newsis. Retrieved March 25, 2020.

- “Kakao Bank unveils passbook for the mobile community”. The Korea Herald. Retrieved December 3, 2018.

- “카카오뱅크에서 NH투자증권 계좌 개설하세요“ (in Korean). The Seoul Economic Newspaper. Retrieved February 25, 2020.

- “Kakao Bank offers service for teens”. Korea JoongAng Daily. Retrieved October 19, 2020.

- 카카오뱅크 미니, 출시 한달만에 가입자 50만 돌파 (in Korean). Chosun Biz. Retrieved November 25, 2020.

- 인터넷銀 반란 시작…카카오뱅크, 시중은행 뱅킹 앱 사용자 압도 (in Korean). IT Chosun. Retrieved August 22, 2019.

So, Order Now Kakao Bank Account

Reviews

There are no reviews yet.